TIMKEN (TKR)·Q4 2025 Earnings Summary

Timken Beats Q4 on Both Lines, Guides Higher for 2026 as Stock Hits 52-Week High

February 4, 2026 · by Fintool AI Agent

Timken Company (NYSE: TKR) delivered a solid beat on both revenue and earnings in Q4 2025, with sales of $1.11 billion (up 3.5% YoY) and adjusted EPS of $1.14. The engineered bearings and industrial motion specialist guided 2026 adjusted EPS of $5.50-$6.00, representing potential 8% growth at the midpoint versus 2025's $5.33. Shares hit a new 52-week high of $96.14, up 11.4% YTD.

Did Timken Beat Earnings?

Yes — Timken beat on both revenue and EPS.

*Values retrieved from S&P Global

The beat was driven by higher pricing, favorable currency translation, and strong volume growth in the Industrial Motion segment. Organic sales were up 1.3% YoY despite lower end-market demand in the Engineered Bearings segment.

Cash generation remained robust with free cash flow of $140.7M in the quarter (+12.6% YoY) and $406.1M for the full year (+32.8% YoY).

What Did Management Guide?

Timken provided initial 2026 guidance that exceeded current Street expectations:

The 2026 guidance midpoint of $5.75 adjusted EPS compares to Street consensus of $5.27*, implying upside to estimates. The guidance bridge includes:

- Acquisition-related intangible amortization: ~$0.85 per share

- Impairment, restructuring and other items: ~$0.15 per share

*Values retrieved from S&P Global

CEO Lucian Boldea, who took the helm in September 2025, expressed confidence: "We expect to generate organic revenue growth, strong cash flow, and higher margins and earnings in 2026."

Guidance Assumptions:

- Q1 organic sales expected flat YoY (pricing up, volumes slightly down due to tough comp)

- Full-year split: ~54% of adjusted EPS in H1, ~46% in H2

- ~30% incremental margins on volume growth

- Currency adds ~1% to revenue (~3% in Q1)

- CapEx at 3.5% of sales (low end of typical range)

CEO on First 100 Days: Boldea shared that he spent significant time visiting factories to understand operations and sources of differentiation. His key insight: "Almost anything you think about, somebody in Timken is doing it very well. But how do we institutionalize that across the enterprise?"

What's the 80/20 Strategy?

The biggest news from the call: Timken is expanding its 80/20 discipline across the entire enterprise, beyond just portfolio rationalization.

CEO Lucian Boldea outlined the expanded scope:

- Portfolio work — Exiting underperforming businesses (single-digit % of company), including auto OEM

- Operations — Customer/product mix simplification, supply chain optimization, asset footprint rationalization

- Timeline — Expect 2-3 quarters of costs, then costs/benefits neutralize, then net benefit flows through

- Not baked in — 2026 guidance does NOT include significant 80/20 costs or benefits

"We're looking to exit underperforming businesses and prioritize our focus and resources on actions that will have the greatest impact to company margins and growth." — CEO Lucian Boldea

Auto OE Exit Update: Conversations with customers are "mostly complete." Revenue decline expected in 2027, but margin uplift in both 2026 and 2027 from renegotiated terms.

Investor Day: May 20, 2026 in NYC — Management will provide a 36-month transformation roadmap with detailed growth algorithms and financial targets.

What Changed From Last Quarter?

Segment performance diverged significantly:

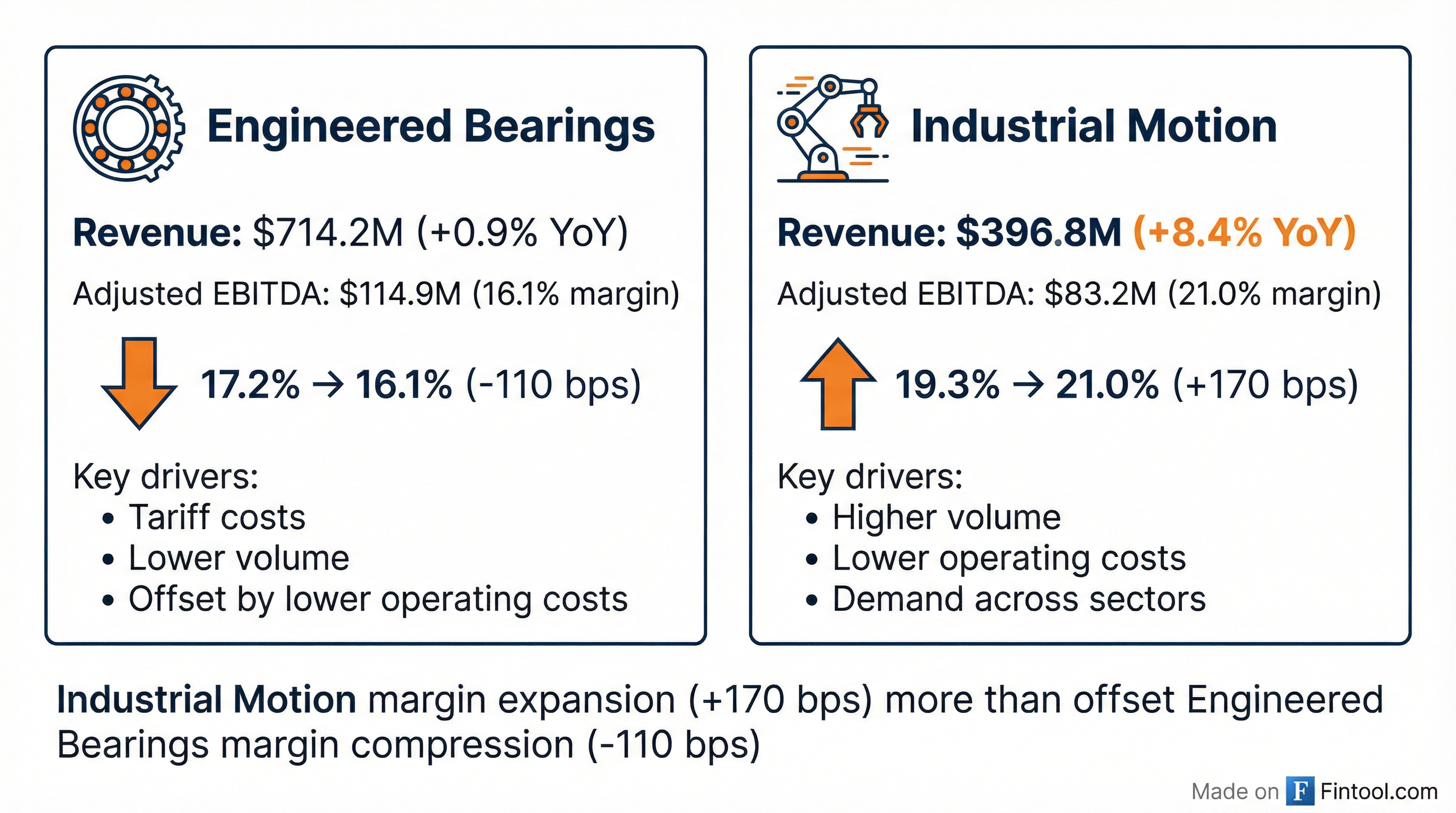

Engineered Bearings (64% of sales)

- Revenue: $714.2M (+0.9% YoY)

- Adjusted EBITDA margin: 16.1% (down from 17.2% YoY)

- Headwinds: Incremental tariff costs, lower end-market demand

- Tailwinds: Lower operating costs, lower material & logistics costs

Industrial Motion (36% of sales)

- Revenue: $396.8M (+8.4% YoY)

- Adjusted EBITDA margin: 21.0% (up from 19.3% YoY)

- Margin expansion of 170 bps driven by higher volume and lower operating costs

The Industrial Motion segment's margin expansion more than offset Engineered Bearings compression, with the segment showing demand strength across most sectors.

How Did the Stock React?

TKR shares reached a new 52-week high following the earnings release:

The stock has been on a tear, up 71% from its 52-week low of $56.20. The combination of a double-beat, raised 2026 guidance, and new CEO momentum appears to be driving investor confidence.

Full-Year 2025 Performance

Organically, 2025 sales were down 1.0% vs 2024, with the modest reported growth driven by the CGI acquisition, pricing, and currency. The standout was cash flow — Timken generated $554M in operating cash flow and $406M in free cash flow, up 33% YoY.

Capital Allocation

Timken maintained its disciplined capital allocation in 2025:

- Dividends: $155.7M returned to shareholders (12th consecutive year of increases)

- Share Repurchases: 780,000 shares repurchased

- Debt Reduction: Total debt reduced by $140.7M; net debt down $131.9M

- Balance Sheet: Net debt / EBITDA at 2.0x

Q&A Highlights

Order Book Strength: Orders ended 2025 up high single digits YoY, with off-highway, general industrial, wind, and aerospace as the biggest contributors.

Automation Opportunity: Industrial automation was a key growth driver, particularly in linear motion. The Americas linear motion business is up 20% (off a smaller base) after targeted investment. Management sees humanoid robotics as "early days" but is actively working with OEMs on key programs. The broader industrial automation opportunity is more immediate.

Regional Dynamics:

- India — Strong and more than offsetting China weakness

- Europe — "Pleasant surprise" with continued strength from Q3 into Q4

- China — Still down, with solar a major drag

- Latin America — Weak

- North America — Doing okay

End Markets:

- Strong: Off-highway (ex-agriculture), general industrial, wind, aerospace

- Weak: Agriculture, oil & gas, metals, heavy truck, auto OE

- Distribution: Inventories healthy, expect low single-digit growth in 2026

Tariff Outlook: Timken expects to fully recapture tariff-related margin impact by the time they exit 2026. The $0.10-$0.15 EPS benefit in the 2026 bridge includes pricing actions weighted more heavily to H1.

New Leadership Appointments:

- Chief Technology Officer (new position)

- Vice President of Marketing (new position)

- Regional Presidents

These additions are designed to fuel innovation, strengthen commercial execution, and align the organization with macro growth trends (electrification, automation).

Key Risks Flagged

Management's forward-looking statements highlighted several risks:

- Tariffs and trade policy — Incremental tariff costs already impacted Q4 Engineered Bearings margins

- End-market demand fluctuations — Engineered Bearings saw lower demand while Industrial Motion strengthened

- CEO transition — Lucian Boldea took over in September 2025 after Tarak Mehta's sudden departure in March 2025

- Pension/postretirement obligations — Q4 included $10.8M in actuarial losses from plan remeasurement

The Bottom Line

Timken delivered a clean beat with Q4 revenue +3.6% and adjusted EPS +4.6% above consensus. The 2026 guidance of $5.50-$6.00 adjusted EPS sits well above Street expectations of $5.27, suggesting estimate revisions ahead. Industrial Motion's margin expansion (+170 bps) demonstrates the portfolio's resilience, while robust free cash flow generation ($406M, +33% YoY) provides flexibility for M&A and shareholder returns.

The bigger story from the call is the 80/20 expansion across the enterprise. This isn't just portfolio pruning — it's a comprehensive operational transformation touching customer/product mix, supply chain, and asset footprint. The May 20 Investor Day should provide a 36-month roadmap with specific financial targets.

New CEO Lucian Boldea brings urgency and discipline after 100+ days of intensive factory visits and process reviews. His focus on institutionalizing best practices across a company built through acquisitions could unlock meaningful margin improvement. The stock's move to 52-week highs suggests the market is buying into the transformation story.

Conference call held February 4, 2026. Transcript available.

Related: TKR Company Profile | Q3 2025 Earnings | Q4 2025 Transcript